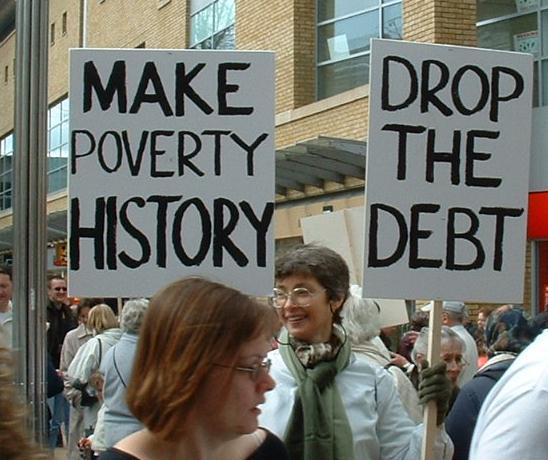

At a time when there seems to be a hip and happening interest in the worsening conditions of certain peoples on the globe that even the local rock station (which I used to work for but left because of the abhorrently low wages they pay their people) and blogs are talking about "making poverty history," I thought it appropriate to post something I wrote three years ago...

Musings

It seems almost hollow to begin this paper with facts. Empirical evidence that something is terribly wrong with our world today, as though facts were not argument enough. So what if half the people on earth must make do with two dollars a day? So what if the gap between the richest and the poorest continues do widen as we speak? So what if seven million children die each year because of debt repayments? Shouldn’t debts be honored?

The numbers are drummed in, but somehow, people are unmoved. What do these figures mean to us? Perhaps if we today were living in New York or London, these figures would mean little. Here, in this city, one need only look outside one’s window, walk a few meters from one’s house, and see that something is wrong. In this city, in the middle of a third world country, these figures matter. Included in the seven million are some 1.5 million Filipino children , and it does not stretch the imagination to picture all those people living in shanties across the metropolis as numbering among the three billion. When something is staring you in the eye, you cannot blink and pretend not to see.

Why $200 billion, the estimate I read in the paper the other day, would be spent bombing suspected "terrorists" into smithereens, when the same amount could be spent on something that wouldn’t involve killing and needless waste. It is the height of irrationality.

Of course, one might say, it is their $200 billion to spend, to do with as they please. They could dig a pit, throw all the greenbacks in, light it up and have themselves a merry little bonfire, and its still their money. And our problems are still ours. Those street children out in Manila’s thoroughfares are our street children. One could say, so what if Sub-Saharan Africa will have 71 million less people, having died of AIDS, by 2010 ? It is their epidemic to deal with. It will certainly end their suffering.

It is this way of thinking, this perception one, like you or me, might come across in our pursuit of truths. In the era of so-called globalization, the world’s ills are probably not among those that go global. Things such as hunger, famine, illnesses, destitution, and ignorance do not travel the earth in, say, a click of a mouse unlike huge amounts of money. Clearly, we are not living in a global village with one tribe if half the population struggles to make life livable and the other much more affluent half looks on with blank faces.

Hardly anybody speaks of dependency or underdevelopment today. The catchphrase these days is liberalization and globalization, as though these two always come in tandem. Liberalize to globalize, globalize to develop, and so we are led to believe. And yet it has not been so glaringly evident that there is a need to talk about dependency. It is the modest aim of this paper to show that conditions of dependency continue to exist (it has never gone away), that the vagaries of those in power continue to be exercised over those who are not, through the instrument of debt.

Third World Debt, in a span of a decade, has not decreased even though debtor countries, like the Philippines, have painstakingly ‘serviced’ their debts. Anyway, they have not had a choice in the matter. External debt in 1982 stood at $745.1 billion. In 1992 it doubled at $1,520 billion (Chew & Denemark, 1996: 120). In 1997, it stood at over $2,000 billion. One need not be an mathematician to detect a trend.

Origins of Debt

A significant cause of the heavy borrowing of poor countries seem to have stemmed from the quadrupling of oil prices in 1973. Suddenly, the Middle East was swimming in ‘petrodollars.’ Their money had to go somewhere. They couldn’t very well bury them under the desert sand. So these went to the international banks. Money collecting mildew? This couldn’t very well happen, which prompted the banks, in their good conscience, to lend to much of the developing countries in bad need of financial means. Thus the term “recycling of petrodollars.” During the decade, the IMF encouraged increased lending “to create unmanageable demands for reverse flows (Passe-Smith, Goddard & Conklin, 1996: 308).”

If only the Organization of Petroleum Exporting Countries hadn’t raised oil prices, then the magnitude of debt would not have been aggravated. What prompted the OPEC, already in existence since 1960, to clamor for a increase in oil prices thirteen years later?

Raffer offers one explanation. ‘Big Oil’ and the US Administration “became interested in higher oil prices (Raffer, 1987: 159).” Why? For one, the major oil companies drilling for oil were American (Exxon, Mobil, Texaco). These companies were headquartered in Saudi Arabia, the largest oil producer and owner of ¼ of the world’s known oil reserves. If they decided they wanted more profits…then they acquired more profits. See, the logic is fairly simple. Clearly, the Oil Industry continues to enjoy considerable influence over the US government, as can be demonstrated from recent events.

“The effects of the oil price increase would give the USA competitive advantage vis-à-vis Europe and Japan (Raffer, 1987: 162).” In short, the oil price hike was instigated by the US, and the OPEC took the fall as the culprit.

Whose Crisis Is It Anyway?

If in 1992, LDC debt doubled, as the Philippine debt has since 1985 also doubled , why are we not talking crisis here? Why did Michel Camdessus, then IMF director, declare that “the debt crisis has been tamed although a few indebted countries still have to make efforts to overcome their economic and other problems (Chew & Denemark, 1996: 115)?”

Was 1982 dated as the onset of the Debt Crisis because Mexico, one of the largest debtors, declared it could not pay its debts? Was it because the Mexican $85 billion liability included loans that “accounted for significant percentage of the capital of the largest US banks,” (Spero & Hart, 1997: 188).

The ‘international creditor regime’ were mainly concerned with maintaining scheduled payment of fees, commissions and interests from borrowers (Lehman, 1993: 31). The debt management schemes pursued during the early phase of the crisis were to ensure that payments did not stop. And they didn’t. The IMF, serving as an intermediary between creditors and borrowers, made sure of it. “…the IMF provided a vehicle for imposing and surveying national economic policies deemed necessary for debt repayment. The IMF could hold up its lending and all rescheduling if a debtor did not agree to certain policies (Spero & Hart, 1997: 189).”

The policies pursued from 1982-1984 were mainly austerity programs; “spending restraint, reduced subsidies and higher taxes (Spero & Hart, 1997: 190).” A second strategy called for structural changes in the debtor economies, ostensibly, to make their economies much more efficient, making more money and being better able to pay debt. This was the beginning of the language of liberalization. Trade and finance liberalization meant reduction of tariffs and greater access for foreign direct investment. Deregulation meant reducing subsidies, interest rate controls and exchange rate regulations. Privatization meant selling state-owned industries (Spero & Hart, 1997: 193).

Effects of these structural adjustment programs will not be discussed in this paper. Suffice it to say that whatever intervention the national governments could impose on ameliorating living conditions within their territories had to be ‘voluntarily’ ceded to meet with the international creditor’s demands. Whatever illusions of sovereignty were relinquished and certainly, whatever calls for development, for greater equity, for redistribution of wealth had come to an end. “By the end of the 1980’s the only development policy that was officially approved was not to have one… (Leys, 1996: 24)” Leave it to the market to allocate resources, not the State.

…the specific policies of the IMF are designed to ensure that the burden of adjustment is placed onto non-elite classes. This is not merely because of the economic framework of the IMF but because securing the cooperation of local elites for the implementation of IMF programs involves sparing them the costs of adjustment (Passe-Smith, Goddard & Conklin, 1996: 255).

Today over 50 countries are in debt, 40 of which the IMF calls ‘heavily indebted poor countries.’ The IMF harbors an illusion that this debt will, some day, be repayed. Debt cancellation, according to them, is not the solution for an overall strategy to fight poverty.

HIPCs and many other poor countries will rely on external financing for their development needs long into the future. A growing portion of this need is being met by bilateral and multilateral agencies on concessional terms. Total cancellation could imperil these funds.

Twenty years after the onset of the crisis, the solution doesn’t seem forthcoming. Probably not in the next hundred years. Who knows? Unequal exchange persists. Instruments of trade such as the WTO are battlegrounds littered with dead Third World good intentions and hopes. It looks like debt continues to be another mechanism where the rich not only exercise control over the poor, but actually make a killing form them.

Conclusion; More Musings

Dependency speaks to those of us who have removed our blinders. Through the heavily tinted windows of six-figure imported modes of transportation our policy makers and leaders seem to prefer, it is quite easy to divorce oneself from the reality on the other side of the tinted view.

Between the incremental, sometimes drastic increase in prices of petroleum products, everything sold in supermarkets and public markets, everything sold in malls and department stores, everything sold on sidewalks; the minimum wage still pegged at P250 since God knows when; the devaluation of the peso from P27 five years ago to P52 today, the ‘highly abstract’ notion of a core and periphery, the language of dependency, is not difficult to comprehend.

Dependency theory, with its notion of a world economy that creates wealth for a few and deprives many more, speaks to me quite simply. The evidence continues to unfold before my open eyes.

No comments:

Post a Comment